Aussie biotechs have been in the wrong part of the Venn diagram of two brutal selloffs: ASX small caps and biotech. But a handful have released stunning data in recent months.

First amongst these is Clarity Pharmaceuticals, which is operating in a red-hot space going through a wave of revenue growth and M&A.

Novartis launched Pluvicto, a radiotherapy for prostate cancer, only last year and is expecting to clock over $1 billion of sales in its first year.

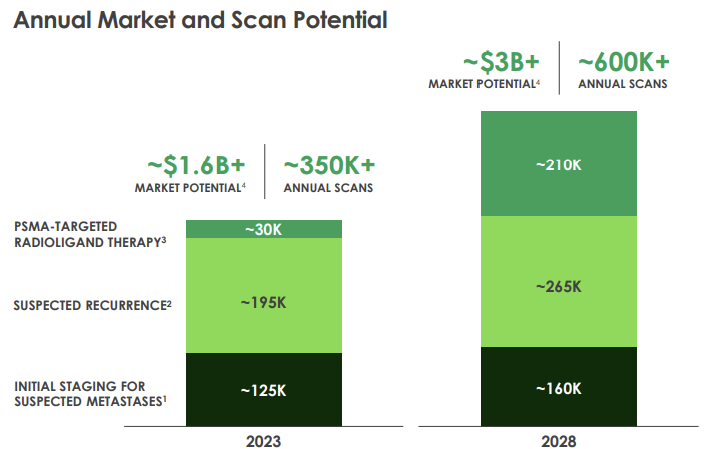

On the diagnostic side, local darling Telix has taken market share from Lantheus, which has itself built a substantial business in a short period of time. Urologists are switching to radiodiagnosis en masse to test for metastasis and recurrence. The extent of this has surprised the market as patients are tested multiple times - initial estimates of a $500 million market have expanded to $3 billion.

These tests are not very sensitive however, and there is significant need for something better.

In big pharma, Eli Lilly and Bristol Myers Squibb have made headline-grabbing acquisitions, while Pfizer and Johnson & Johnson have enormous prostate cancer franchises to protect and are yet to make a move.

Background

After non-melanoma skin cancers, prostate cancer is the most common cancer in men.

Most prostate cancers are harmless, but the same cannot be said of the cure.

Treatment involves radical prostatectomy to remove ‘the true heart of the male’, hormone therapy, and traditional radiotherapy and chemotherapy. These come with a bleak list of side effects: incontinence, impotence, loss of interest in sex, and depression.

Even traditional diagnosis, which involves poking holes in the prostate through the anus, comes with obvious risks.

With milder side effects, Novartis’s new treatment Pluvicto is approved only after the failure of prostate removal, anti-androgen therapy, and chemotherapy. Studies are testing whether this can be moved further up the timeline, and this can’t come soon enough.

The hope is that the next generation of radiopharmaceuticals will be able to differentiate between harmless and metastatic disease, limit unnecessary treatments, catch any recurrence, and ultimately cure prostate cancer without such bleak side effects.

Radioligands

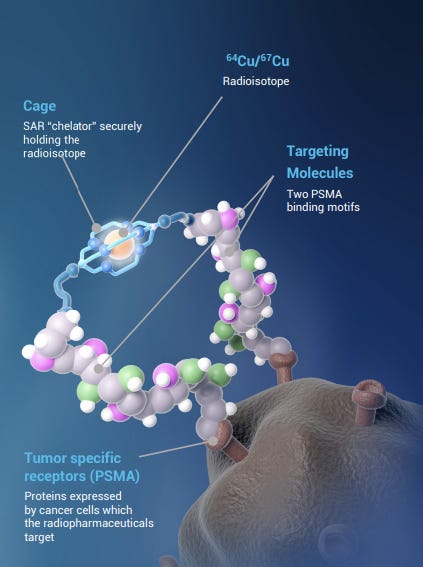

Radiopharmaceuticals link a highly radioactive compound to a molecule that binds to an over-expressed protein on a cancerous cell. Prostate cancer is an early, successful target due to the existence of PSMA: prostate-specific membrane antigen. The name says it all.

This is different to traditional radiotherapy where energy beams from different angles deliver a toxic dose to a particular point, and invariably blast other cells along the way. With radioligands, the radioactivity comes from inside, or rather, on the surface of the cell.

Radiodiagnostics with lower doses of milder reagents bind to PSMA on cell membranes and are lit up on PET scans.

The same binding ligands, attached to more powerful radioactive payloads, kill PSMA-expressing cells by ripping apart their DNA.

PSMA is also expressed in the salivary glands, which is why Pluvicto leads to metallic taste and dry mouth.

Naturally, treatment is a larger and more consequential market.

This approach is similar to antibody-drug conjugates (ADCs), where an antibody linked to a drug delivers a payload right where it is needed, only with ADCs the drug needs to be taken up inside the cell (radiopharmaceuticals bind to the surface of the cell).

This has been very successful. Antibody drug conjugates have generated enormous wealth for those who backed them at similar stages to where radiopharmaceuticals are today.

And much of this wealth was crystallized in recent weeks.

Pfizer closed its acquisition of Seagen for $43 billion in December last year, and only two weeks before, Amgen announced the acquisition of Immunogen for $10 billion. And on January 8 this year, Johnson&Johnson announced the acquisition of Ambryx for $2 billion.

Clarity

Clarity’s take on the technology involves a secure cage holding the radioactive copper atoms (rather than the Lutetium or Fluorine used by Novartis, Lantheus and Telix), minimizing leakage. Nobody wants radioactive molecules floating around messing with their DNA.

This novel cage, developed in Australia, allows Clarity to have composition-of-matter patents which current Illucix (Telix) and Pylarify (Lantheus) lack.

A key breakthrough was using two linkers to bind to the cancer cell instead of one (the bis in SAR-bisPSMA).

Which led to substantially more powerful binding:

Invasion of the prostate snatchers

Written in 2010 and updated in 2021, ‘Invasion of the Prostate Snatchers’, makes the case that early-stage prostate cancer is over-treated with surgical castration and hormone therapy.

The author1 has an eye for a quote.

A surgeon won’t operate on anyone over 70 ‘unless both parents are present’.

The Greek physician Parmenides declares ‘give me the power to produce fever and I can heal every illness’ (malaria was an early cure for syphilis).

A Greek philosopher, when relieved of morning erections for the first time in his adult life, runs through the streets crying ‘free, free at last!’

Hippocrates would ‘rather know what sort of person has a disease than what disease a person has’.

‘Half our mistakes in life arise from feeling when we ought to think, and thinking when we ought to feel’.

The prostate is ‘slung under the bladder, circling the urethra, with the nerves that control erections wrapped around its surface’, the reason complications with treatment are all but inevitable.

And:

Patients are too often rushed into a radical prostatectomy, a major operation that rarely prolongs life and more than half the time leaves them impotent.

Only half of those undergoing the most radical surgeries have erections ever again.

There are some startling anecdotes. One doctor, treated for prostate cancer, diagnoses a perforated rectum when he farts out of his penis.

100% of men are incontinent for a few months after operating, with many staying incontinent for the rest of their lives.

Stress incontinence is common: urinary leakage triggered by sneezing, coughing, jumping or laughing. Climacturia, the ejaculation of urine during sexual activity, occurs in about 20-28% of men undergoing radical prostatectomy. Memory loss from general anaesthesia in the elderly adds to the risk.

So it’s very important to know which prostate cancers are benign (most) and which require radical intervention in a most sensitive area.

The book is well worth a read with some minor niggles: there’s are a little too much on alternative treatments, self-hexing and the like. Positive thinking is great but sadly attitude can only take you so far. No matter how positively you face the world, we all have a terminal diagnosis.

Diagnostics

One solution to radical interventions is active surveillance and only progressing those testing positive for metastatic disease to the most radical treatments.

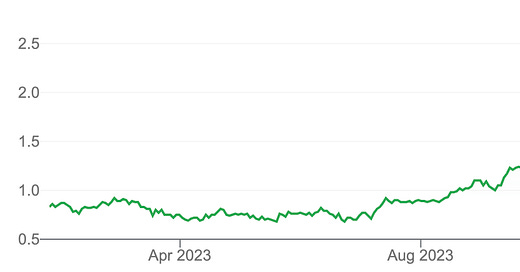

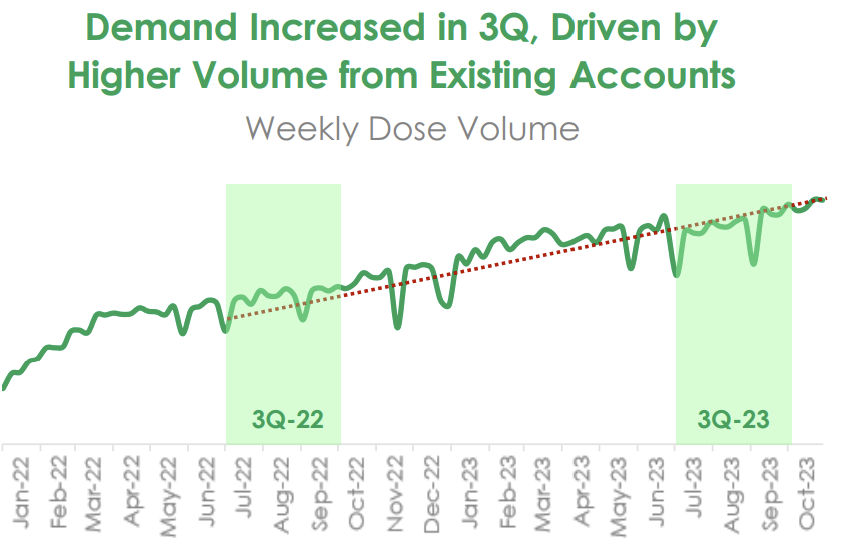

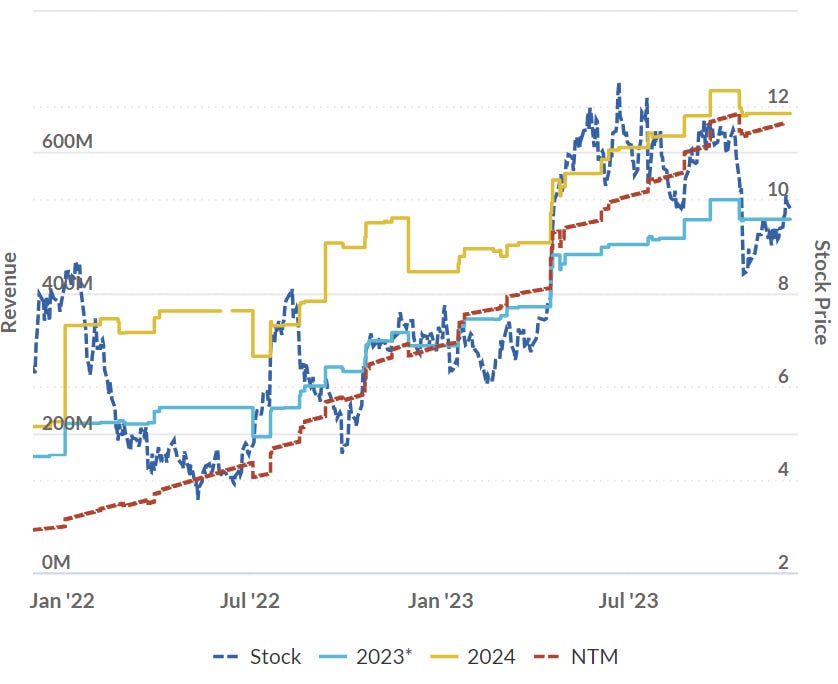

Lantheus markets Pylarify, a fluorine-based PSMA-targeting imaging agent. This is generating US$214 million a quarter in revenue (~A$1.2 billion a year) and growing:

The market is forecast to double from $1.6 billion to over $3 billion by 2028, driven by an increase in PSMA-targeting radiotherapies and a general 2-3% increase in prostate cancer incidence per year (some forecasts are as high as 5% per annum).

Local investors will be familiar with Telix, which has generated substantial wealth on the ASX and seemingly summoned other radiotherapy companies into local existence.

Telix’s Illucix competes with Lantheus’s Pylarify in PSMA-targeting imaging, and is forecast to generate A$500 million over 2023.

Telix trades for around US$2 billion/A$3 billion, a similar valuation to Novartis’s Phase II purchase of Endocyte, albeit with approved revenue generating products.

The comparison is not quite apples to apples given Endocyte was a therapeutic and Telix’s marketed product is a diagnostic, but it does give an indication of where Clarity’s value may lie on successful execution of their programs.

It’s always encouraging to see forecasts trending like this:

The next uplift in value for Telix will require success in their antibody-based treatment for prostate cancer, and/or success in their renal cancer and glioma programs.

There is a major problem though

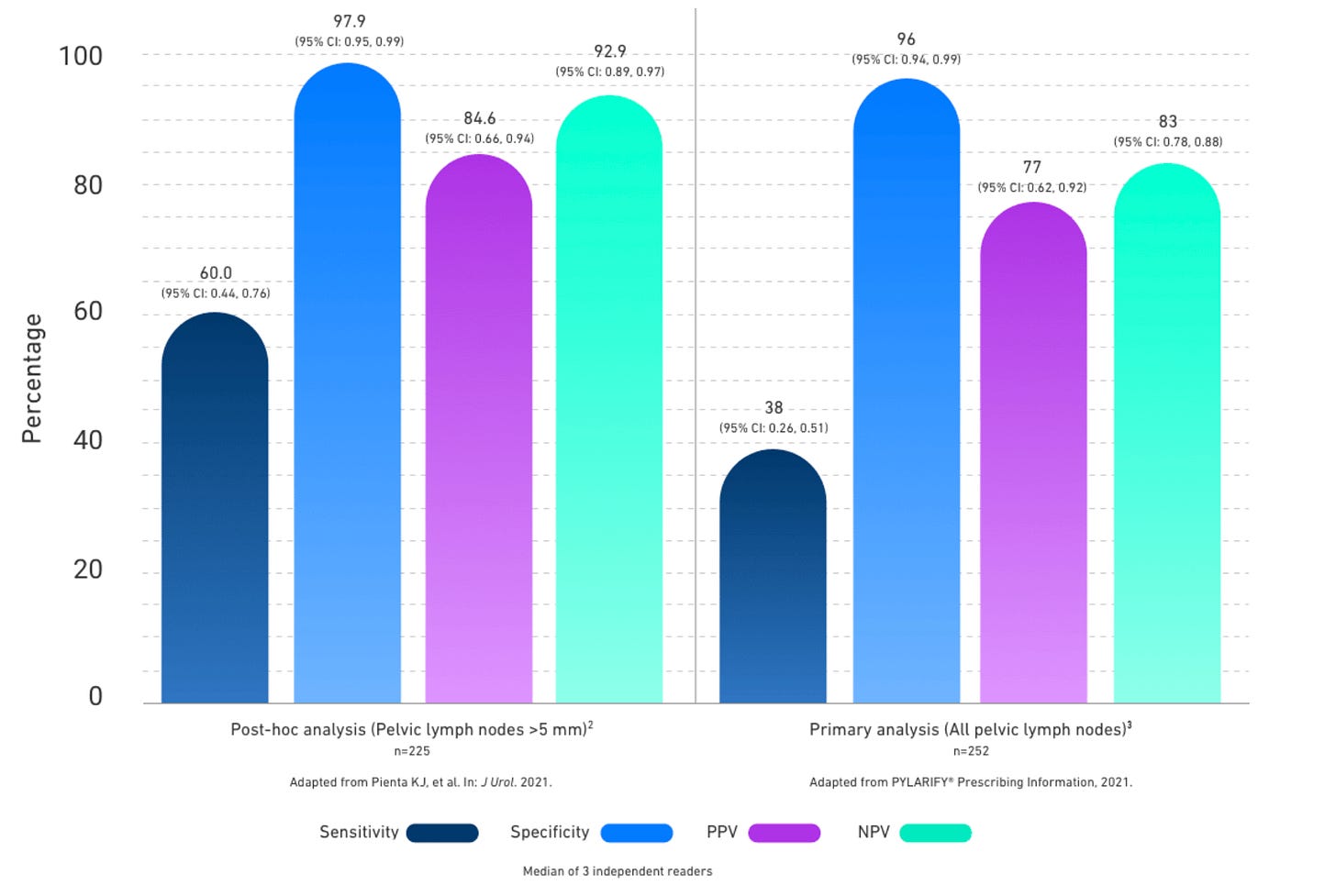

The PSMA tests from Lantheus and Telix are not very sensitive, particularly in advanced cancer when testing for recurrence.

Lantheus and Telix have grown rapidly as they are both better than the prior standard-of-care, but there is a desperate need for better diagnostics to catch more metastases and give confidence to those trying to avoid more intense lines of treatment for non-fatal cancers.

This gap in sensitivity is the Achilles heel for Illucix and Pylarify, and an opportunity for any company who can demonstrate a meaningful improvement.

Specialists seem to be largely ambivalent between the two, though Pluvicto can only be used with a Gallium diagnostic, a benefit to Telix.

Curiously, Novartis has their own Gallium-68 diagnostic approved, but has chosen not to market it. Novartis diagnostic Locametz is basically the same as Telix’s Illucix, and was approved at the same time as Pluvicto, presumably so Novartis wasn’t beholden to a company in Australia.

I am not sure this is fully appreciated by the market: Telix has built their business on the back of a generic. It was developed in Germany in academia. If Novartis marketed their diagnostic aggressively, Telix would be a different company today.

If Novartis chooses to divest its diagnostic (there are rumours) the buyer can be expected to market it.

This is a competitive space, and there does seem to be early indications of pricing pressure.

Clarity vs current imaging agents

In early studies, Clarity’s copper imaging agent has important benefits over existing reagents:

Copper-64 has a higher half-life: 12.7 hours versus 1.1 hours for Gallium-68 and 1.8 hours for Fluorine-18,

There is greater uptake into lesions,

Image resolution is sharper,

More lesions can be detected,

There is potential for delayed imaging, up to 72 hours after intake,

And shelf-life is improved.

Later stage trials in progress will prove or disprove the extent of this advantage. We will find out this year.

Trials have been small, but the data points one way.

Clarity recently completed their Phase 1 study with 30 patients. A greater number of lesions were detected with copper, and the lesions that were identified showed higher uptake relative to Gallium:

A study comparing their reagent to the Fluorine-18 used by Lantheus will read out soon.

Clarity has begun their pivotal Phase III trial with 383 patients. This is powered to support an application to the FDA for approval of 64Cu-SAR-bisPSMA as a new diagnostic and competitor to Telix’s Illucix, Lantheus’s Pylarify, and Novartis’s Locametz.

Anecdotally, Clarity’s test was used in a compassionate use setting in Melbourne in four patients that were cleared by PSMA tests, but wanted to be sure there was no life-threatening metastasis. In all four, new metastases were discovered.

One thing’s for sure: competition in diagnostics will heat up.

Beyond PSMA

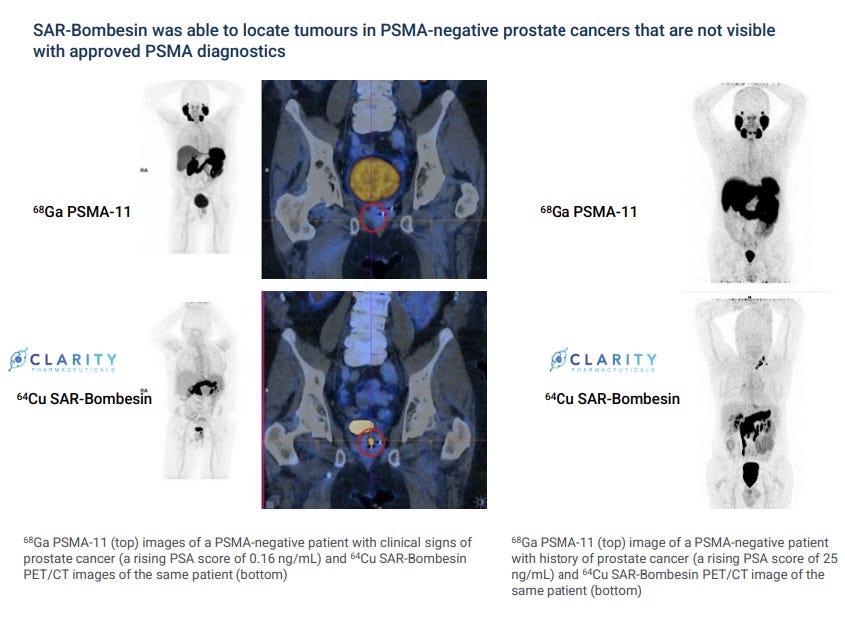

Some 10% of prostate tumors don’t express detectable PSMA and go on to metastasize.

Fortunately, Clarity is also targeting a different protein expressed on prostate cancer cells: GRPr. This new moiety (SAR-Bombesin) is in Phase I/IIa as a treatment and Phase II as a diagnostic, with data set to be released in the first half of 2024.

The nature of these molecules - a binder, linker and payload - means it’s possible to optimize different components separately. The payload can be made more or less toxic, and the binder can target different tumor receptors.

In Sydney, another four patients who accessed the diagnostic scanned negative on existing PSMA tests. All four tested positive with Clarity’s SAR-Bombesin.

This is one of the more exciting parts of Clarity’s pipeline, as being able to confidently test for PSMA-negative metastases will be critical to minimizing radical interventions.

For Clarity, is an important differentiator to others developing assets in the market.

Therapeutics

The real money - and big pharma interest - is in curing disease.

In recent weeks Bristol Myers Squibb bid $4.1 billion for RayzeBio, a radiopharmaceutical company which was only set up in 2020. Give that founder a medal!

Not that he’d be short of gold right now.

RayzeBio is using an Actinium alpha-emitter in a Phase III trial to target neuroendocrine tumours.

You may recall that alpha particles (basically helium nuclei) are larger with higher ionizing capability than beta-particles (basically electrons), and so have greater potential to damage cellular DNA and kill troublesome cells. Specifically, alpha particles cause double-stranded breaks in DNA rather than the single-stranded breaks caused by beta particles.

The shorter range of alpha particles is helpful as it limits damage to healthy cells.

In Phase I, after which they moved straight to a pivotal trial, the company observed an objective response rate of 29% with monitoring ongoing. These patients had already been treated heavily, including with a Lutetium radiopharmaceutical, so any response at all was encouraging.

Still, this looks like a rich price.

RayzeBio has limited IP. The binder and linker are the same used by the existing Novartis competitor, Lutathera, and you can’t exactly patent Actinium.

A note for those hoping for a buy-out of their radiopharma stock: BMS didn’t pay massive overs for a diagnostic, they chose one focused on cures.

Lantheus just announced acceptance of its application for a generic version of Novartis’s Lutathera, used in neuroendocrine tumours. Competition all around.

Prostate cancer is big business. Sanofi markets the chemotherapy drug docetaxel, Johnson & Johnson markets the hormonal agents abiraterone and apalutamide, and Pfizer/Astellas markets Enzalutamide. All could be potential acquirers of companies with therapeutic assets.

Lantheus too could be an acquirer of Clarity, given they use the same distributor (Siemens). This is all speculative, but as a shareholder, I’m hoping the company maximizes the value of these assets, as it’s rare to be in such a promising position.

Pluvicto - Novartis’s radiotherapy for prostate cancer

Novartis acquired ‘Pluvicto’, their Lutetium-177 PSMA-targeting agent, through the US$2.1 billion acquisition of Endocyte in 2018 on the back of promising Phase II data.

Companies with strong Phase II data make for good buy-out candidates as there’s enough data to give confidence of success and the purchaser can design and run their own pivotal trial.

Adding Pluvicto to standard-of-care roughly doubled median radiographic progression-free survival to 12.0 months. This may not sound like much, but these were very sick and heavily-pretreated patients with metastatic, castration-resistant(!) cancer.

Novartis predicts peak revenues of US$2 billion for Pluvicto, but moving radiotherapy to a front-line setting could double or triple this number… which is enough to move the needle for big pharma.

Lantheus rested its therapeutic hopes on a partnership with Point Biopharma and their Lutetium-based therapeutic, which was recently purchased by Eli Lilly for $1.5 billion - a clue as to what Eli Lilly will do with their immense GLP-1 cash flows.

The acquisition occurred before the release of pivotal Phase III data, and while it’s great to see big pharma paying up for early-stage radiotherapy companies, perhaps they should have waited.

In December, Point released data showing they met the trial endpoint, but failed to show superiority against Novartis Pluvicto, in fact, the opposite.

Progression free survival was extended by only 9.5 months, vs Novartis’s Pluvicto at 12 months, in a similar population.

It is unclear how Eli Lilly will progress from here. They don’t exactly need to invest in a second-best asset given the immense sums at stake in GLP-1s. Something to watch.

Lantheus sold off on the news, and now trades on an after-tax PE of 8.9. There is a lot riding on their success in therapeutics.

The trial failure may have some read-through to the prospects of Telix’s own Lutetium-177 candidate.

On the plus side, Telix chose to test their agent alongside the current standard-of-care, rather than the much harder head-to-head comparison chosen by Lantheus.

This gives better odds of success, and would allow for a better label, as physicians have a compelling reason to add Telix’s agent to the treatment cycle.

It’s an easier decision to add to an existing regimen rather than change it.

Telix is using an antibody as a binder which allows for a much shorter dosing window and potentially greater selectivity, with a larger molecule less likely to penetrate where it’s not supposed to be.

Optimism around the asset depends who you talk to, I think we will just have to wait for the data.

Success in therapeutic programs is critical to the next value uplift in both Lantheus and Telix.

Telix in Renal Carcinoma

I don’t want to be too negative on Telix. They have a promising program in renal cancer, and the regulatory submission to the US FDA has commenced under a rolling review. If all goes well this could be approved later this year - and they will have another revenue generating product on the market.

Renal cancer is currently imaged with MRI, which can identify a suspicious lump, but not the biology. Surgical removal is the best way to avoid metastatic disease, but this causes a lifetime of health issues. Telix’s product tests for the most dangerous form, clear cell renal carcinoma, which would hopefully stave off unnecessary surgeries.

There is no competition for a similar diagnostic, and unlike Illucix, Telix owns the IP.

And if the diagnostic lights up a cancer cell, the therapeutic version, with the same binder, might effectively kill it.

Clarity in Therapeutics

Clarity is conducting a dose escalation study testing their therapy. With big pharma paying such enormous sums for therapeutic assets, the stakes are high.

Cohort data is being released as it comes.

In the second cohort, the three patients had a reduction of PSA of 80%, 95%, and 99%. Clarity’s diagnostic showed lesions vanishing. (PSA = prostate specific antigen, a marker of tumour burden and an indicator of prostate cancer deterrence)

After receiving the first dose of 8GBq in the trial, the FDA’s expanded access program allowed Clarity to dose a second time. This led to undetectable levels of PSA, which is starting to look like the word noone’s allowed to say: a cure.

No dose-limiting toxicities have been observed so far, with radiation of 12GBq higher than Pluvicto’s 7.6 GBq.

The tumors vanished:

This particular patient had been treated unsuccessfully with androgen deprivation therapy, chemotherapy, and a PARP inhibitor.

A 50% reduction in PSMA is the endpoint of the trial, and most patients so far have seen improvements well in excess of this. More evidence will come later as additional patients are treated with two cycles of the highest dose.

Which is why it may be fair to describe Clarity’s work as the next generation of radiotherapy in prostate cancer.

A catalyst-rich year

Over the coming months Clarity will release data from additional patients. As this data will be released steadily, we’ll have some measure of the success of the trial before it’s complete.

Two notes of caution. If the next few patients have poor responses, that will change the picture significantly. And we have limited visibility on patient selection. Perhaps healthier patients are being selected and the treatment is worse than it looks today. Or perhaps, with early success, sicker patients land in the trial, and skew upcoming results negatively. There will still need to be a larger, ideally double-blind trial before we can accurately judge the treatment’s effectiveness.

(I’ve recommended this book before, but there are some powerful examples of where this happened, notably in an AIDS trial where one effective treatment actually failed its first trial. Nurses noticed that every second patient received the drug, so gave it to the patients in the sickliest state. They meant well, but healthier patients got the placebo and sicker patients the drug. It’s lucky someone redid the trial).

Manufacturing

Manufacturing radioisotopes to meet demand is a major issue, with only a handful of reactors and very short half-lives.

Strenuous efforts are being made to address these supply concerns, but even Bayer and Novartis have had to halt production at times due to supply issues, leaving revenues missed and patients untreated. Clarity’s copper products have a 48-hour shelf-life and are generated in widely available cyclotrons and electron accelerators.

Part of the value of Telix and Lantheus centers around the supply chains they’ve developed to deliver short-lived reagents to treatment centers. The half-lives of the relevant Gallium and Fluorine isotopes are measured in hours.

If you speak to Lantheus or Telix they make much of this logistic advantage, but ultimately, I suspect supply and logistics will prove a solvable problem.

Summary

So where are we now?

After a blistering run, more than doubling while I’ve been writing this note, Clarity is trading at US$390 million.

Novartis radiotherapy is already at a $1 billion revenue run-rate and is investing in studies to move radiotherapy into earlier lines of treatment.

Lantheus and Telix are fighting it out in diagnostics, with both growing rapidly.

However, there’s a significant question mark over IP, whether Novartis’s agent becomes a real competitor, and whether Clarity or another company can prove greater sensitivity and catch more metastasis.

On the positive side, Lantheus and Telix have substantial revenues pouring in each month and are investing heavily. If either shows success in new indications, particularly on the therapeutic side, there will be a significant step change up in value.

As for Clarity, there is much to prove, but their early data is about as promising as early data can be.

In diagnostics, additional lesions are detected vs existing standards, and in treatment, PSA levels are dropping drastically and tumors melting away in heavily pre-treated patients.

This will become clearer over 2024 as data from more patients and their Phase III diagnostic trial are released. We will not be short of news flow.

It is also clear that the market for radiopharmaceuticals will expand significantly. The side effect profile is vastly superior to the horrors possible with existing treatments.

These research efforts should be seen in the context of more sophisticated approach to curing these cancers. A dry mouth sounds a lot better than incontinence, impotence, and androgen deprivation, academic words for extremely distressing outcomes for patients and their families.

With a red-hot M&A market, Clarity is our top pick on the ASX right now.

Disclaimer: The fund owns shares of Clarity and trades actively in the stocks mentioned above. Needless to say, this is an early-stage healthcare company with considerable risks.

Notes on recent deals and acquisitions

Deal between Lantheus and Point Biopharma

Financial Terms: Lantheus paid POINT $260 million upfront, with potential additional milestone payments of approximately $1.8 billion, plus royalties on net sales of 20% for PNT2002 and 15% for PNT2003.

Development and Commercialization Responsibilities: POINT will fund and complete the Phase 3 SPLASH trial for PNT2002 (treatment for prostate cancer) and a study for PNT2003 (treatment for gastroenteropancreatic neuroendocrine tumors). Lantheus will file the New Drug Application (NDA) for PNT2002 and handle regulatory filings in the U.S. for PNT2003. The companies will form joint steering committees to oversee clinical studies, regulatory filings, manufacturing, and commercial readiness for both products.

Product Details:

PNT2002: A PSMA-targeted 177Lu-based therapy for metastatic castration-resistant prostate cancer (mCRPC).

PNT2003: A somatostatin receptor-targeted radioligand therapy for gastroenteropancreatic neuroendocrine tumors (GEP-NETs).

Deal between Point Biopharma and Eli Lilly

Eli Lilly entered into a definitive agreement to acquire Point Biopharma, valued at $1.4 billion. The terms of this acquisition specified that Lilly would pay $12.50 for each share of Point Biopharma.

The acquisition gave Eli Lilly access to Point Biopharma's pipeline of radioligand cancer therapies, which were in clinical and preclinical development stages. Two of Point Biopharma's leading programs included PNT2002 and PNT2003. PNT2002 is being developed for patients with metastatic castration-resistant prostate cancer who have experienced disease progression after hormonal therapy, while PNT2003 is a somatostatin receptor-targeted radioligand therapy evaluated for use in patients with gastroenteropancreatic neuroendocrine tumors.

3. Acquisition of RayzeBio by Bristol Myers Squibb

Technically there are two, a patient and a doctor